Small Enterprise Funding Companies (SBIC)

Among the only and helpful enterprise funding will be discovered on the Internet. A pressing problem in the meanwhile is whether or not, and how, companies are reassessing their capital investment plans in mild of latest tariff hikes and fears of extra to come. The discount eliminates the need for early stage SBICs to make curiosity payments on the debenture and to make funds on the SBA’s annual charge for five years from the date of issuance, plus the stub interval.

Thrilling new partnership signed in Istanbul: The World Business Angels Funding Forum 2017 (WBAF 2017) and the African Commerce Association for Business Angels (ABAN), might be working collectively to attach African start-ups, SMEs, scale-ups and high-growth businesses with world markets.

The two sorts of funds are related in that they make investments from a leveraged pool of capital usually contributed by limited partners; both compensate the administration team based on a share of income (sometimes 20{a8a20b68aa8ec142edf1882afc33fd3c8fbb19ad79d67013717d577bb8fec4a6}) in addition to charge a fee on belongings underneath administration (usually 2{a8a20b68aa8ec142edf1882afc33fd3c8fbb19ad79d67013717d577bb8fec4a6}); and each are flippantly regulated (as of this writing).

In the course of the 112th Congress, H.R. 3219 , the Small Business Funding Firm Modernization Act of 2011, would have inspired higher utilization of the SBIC program by rising the utmost quantity of excellent SBA leverage out there to any single licensed SBIC from the lesser of 300{a8a20b68aa8ec142edf1882afc33fd3c8fbb19ad79d67013717d577bb8fec4a6} of its non-public capital or $a hundred and fifty million to the lesser of 300{a8a20b68aa8ec142edf1882afc33fd3c8fbb19ad79d67013717d577bb8fec4a6} of its private capital or $200 million if a majority of the managers of the company are experienced in managing one or more SBIC licensed corporations.

New Mexico Small Business Funding Corporation

anonymous,uncategorized,misc,general,other

Discovering The Best Enterprise Investment

Enterprise capital cannot afford to invest in startups except there’s a uncommon mixture of product alternative, market alternative, and confirmed administration.![]()

business investment ideas, business investments tax deductible, business definition investment portfolio, business investment accounts rates, business investment opportunities in south africa

Find Investment Alternatives & Business Proposals

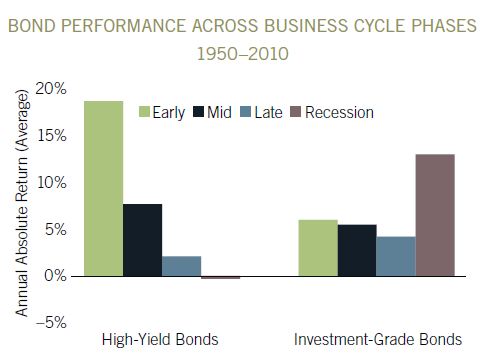

If you’re a small enterprise proprietor, you know the way laborious it is to handle all elements of your business. Incorporating some defensive investments may assist cushion the impact (and positively won’t hurt your portfolio). Typical investments range from $a hundred,000 to $5 million. Bonds, financial savings accounts, and treasury inflation-protected securities (or TIPS) are all lending investments.

Nevertheless, in no event may any SBIC or SSBIC draw down leverage in excess of $ninety million.” An SBIC that engages in leveraging is in essence borrowing extra investment funds from the U.S. Treasury. To make certain, you won’t have the opportunity earn much cash in your investments on the bank.

Business Investment Club (BIC)

When trying to invest in a enterprise there are a selection of criteria on which you’ll evaluate the company earlier than you make your investment. Bloomberg markets additionally reported that internet buybacks (16 p.c) and dividends (11 {a8a20b68aa8ec142edf1882afc33fd3c8fbb19ad79d67013717d577bb8fec4a6}) rose, however not by as much as capital spending (39 p.c). If you are earning 6{a8a20b68aa8ec142edf1882afc33fd3c8fbb19ad79d67013717d577bb8fec4a6} from investments and have a … Read More..

World Enterprise Angels Funding Forum

A few of the simplest and helpful enterprise investment might be discovered on the Web. Although these networks are very reliable for voice communication, they are not effectively suited to service in the present day’s explosive progress of digital communication purposes, as a result of they: are costly to build; must have the capacity from day one to deal with potential progress, rising preliminary costs and creating an underutilized funding; transmit information at very low charges and resolutions, making them poorly suited for delivering excessive-constancy audio, leisure-quality video, or other rich multimedia content material; use dedicated circuits for each call, which allot mounted bandwidth throughout the call’s length, whether or not voice is definitely being transmitted; can’t be leveraged to supply new or differentiated providers or functions, akin to video communication, that the community was not originally designed to accommodate.

Ours is ensuring you’ve gotten a enterprise investment management plan to address your present wants and future targets. Businesses must meet either the SBA’s size normal for the industry during which they’re primarily engaged or the SBA’s different size commonplace for the SBIC program.

After receiving the firm’s utility, a member of the SBA’s Program Growth Workplace evaluations the MAQ; assesses the investment company’s proposal in light of the program’s minimum necessities and management qualifications; performs initial due diligence, including making reference telephone calls; and prepares a written recommendation to the SBA’s Funding Division’s Investment Committee (composed of senior members of the division).

Widening in deficit on revenue was driven by an increase in the income generated by overseas traders on their direct investment in Britain. The SBIC program currently has invested or dedicated about $30.1 billion in small businesses, with the SBA’s share of capital at risk about $14.3 billion.

Localstake

anonymous,uncategorized,misc,general,other

Apply For Small Enterprise Investment Grant

The typical internet revenue for accounting companies companies comes in at 18.3 p.c, offering an surroundings with numerous possibilities for acquire and loads of margin for error.

business investment opportunities in south africa, business investment ideas in pakistan, private business investment definition, business investment opportunities in india, business investments 2018

Companies Are Investing Extra, However It is Not The Tax Minimize

The Department of Department of Tourism, Tradition, Trade and Innovation (TCII) acknowledges enterprise and sector growth as the key to financial growth. And Dean Baker, co-founding father of the liberal Middle for Economic and Policy Research, stated it is onerous to disentangle the impact of the energy markets on this investment from the affect of the tax law. Control—the SBA has stipulated that no SBIC may train either direct or indirect control over the operations of any small business on a permanent foundation.

Most people are inclined to forget how precious is the time that you could spend money on to your enterprise. Reinvestment will all the time be a sensible business transfer. Previously often known as Minority Enterprise Small Enterprise Funding Companies (MESBICs), SSBICs at the moment are officially referred to as Part 301(d) SBICs.

SBA Small Enterprise Funding

… Read More..Franchises For Sale In Texas

We current the newest in what’s new and what’s trending within the industry and the way these components can have an effect on the bottom line. What you are able to do is to initially put in your individual cash or you’ll be able to advertise for traders assuring them high return if they invest through you. A well-written and convincing business plan (and pitch ) presents your small business to traders in detail; but they’re investing in what you are promoting, not just a plan.

The state government of North Carolina must be lauded for his or her efforts for attracting investments to the state. As proven in Desk four , in FY2018, SBICs made 130 financings (4.8{a8a20b68aa8ec142edf1882afc33fd3c8fbb19ad79d67013717d577bb8fec4a6} of all financings) amounting to $132.four million (2.4{a8a20b68aa8ec142edf1882afc33fd3c8fbb19ad79d67013717d577bb8fec4a6} of the entire amount of financings) to minority-owned and -managed small businesses.

The advantage of an angel investor – in addition to the cash they bring about to your enterprise – is that they are normally experienced, profitable entrepreneurs who know the ropes, so they can act as advisers that will help you attain your enterprise objectives.

Upon receipt of a letter of approval you can be requested to pay the balance of the federal government processing charges and what you are promoting investment quantity within a 30 day period. He’s the chairman of the board of directors of Eurobank FPS Loans and Credit score Administration S.A., vice-chairman of ERB Insurance Services S.A. and vice-chairman, non-government, of Eurolife ERB Insurance coverage Group Holdings.

Business Investment Fund

anonymous,uncategorized,misc,general,other

Faculty Of Enterprise

On this instance, the sum of the undiscounted net cash flows is $one hundred twenty five,000, which is bigger than the $one hundred and five,000 required funding.

business investment ideas 2017, business investment account merrill edge, business investment ideas in india, business investment opportunities in nj, business investments examples

The 4 Top Business Investments Proper Now

North Carolina is likely one of the most business friendly states in United States. A pressing challenge in the meanwhile is whether or not, and the way, firms are reassessing their capital funding plans in light of recent tariff hikes and fears of more to return. The low cost eliminates the necessity for early stage SBICs to make curiosity payments on the debenture and to make funds on the SBA’s annual cost for five years from the date of issuance, plus the stub period.

Where a person proposes to make an funding in an permitted business of a minimum of US$ 1,500,000 on their own behalf. For startup loans, the SBA will normally require that at the very least one-third of the required capital be equipped by the brand new enterprise owner.

Owned Business Investment Fund

On the subject of enterprise and actually being successful in your home based business a small enterprise funding is always required whenever you get started. Startups have to cope with starting prices and ongoing companies need to finance growth and dealing capital. The lender, or financial establishment, does not personal shares … Read More..

15 Of The Most Profitable Small Companies Price Investing In

In the case of business and actually being profitable in your house based mostly enterprise a small enterprise funding is at all times required whenever you get started. Earlier than doing so, nonetheless, the SBIC and the small enterprise should submit a plan of divestiture for SBA approval. 15 Bank-owned, non-leveraged SBICs don’t obtain leverage. This ratio is essential as a result of it’s what permits a company to spend money on all the opposite areas wanted to get the product to market akin to advertising and distribution.

Writing within the Guardian, David Blanchflower, a former member of the interest rate-setting financial policy committee (MPC) at the Financial institution of England, said enterprise would discover it exhausting to invest until there was larger clarity on the future path for the economic system.

Not less than two individuals propose to make a joint investment in such an approved business totalling a minimum of US$ 5,000,000, and each of these persons individually propose to contribute at the very least US$400,000 to the joint investment an application or software for Citizenship by Funding could also be submitted on his, her or their behalf via an agent.

The report noted that the SBA’s mortgage packages had been “restricted to providing quick-time period and intermediate-term credit score when such loans are unavailable from non-public establishments” and that the SBA “did not provide fairness financing.” 3 Equity financing (or fairness capital) is money raised by an organization in trade for a share of possession in the business.

Germany Enterprise & Funding Summit

anonymous,uncategorized,misc,general,other

Business & Funding

Attempting to pull your investments out when the market is unhealthy and put them again in when it is good will trigger you to overlook among the greatest returns.

business investment definition economics, business investment account boa, business investment ideas in germany, business investment ideas uk, business definition investment portfolio

Two Types Of Investments In A Small Enterprise

The Division of Department of Tourism, Tradition, Industry and Innovation (TCII) acknowledges business and sector development as the key to economic development. Investments are typically not permitted for undertaking finance, real estate, or passive entities similar to a nonbusiness partnership or belief. Under sure situations, startups and even non-high-development small business can solicit investment from a wider vary of buyers.

Enterprise capital shouldn’t be thought of as a supply of funding for any but a very few distinctive startup businesses. Specialised SBICs (SSBIC) are a particular kind of SBIC that present help solely to small businesses owned by socially or economically disadvantaged individuals.

15 Ways To Make investments Small Amounts Of Cash (And Turn It Into A Giant Quantity

In case you are a small enterprise proprietor, you know how arduous it’s to handle all facets of what you are promoting. In reality, angel funding in startups is way more frequent than venture capital, particularly on the earlier development stages. SBICs invest in a broad range of industries. On the same time, southeast European governments are implementing policies to extend competitiveness, appeal … Read More..